Internal correspondence from the company, which was attached to the petition, corroborates the whistleblower’s allegations.

A former employee of Alpha-Beta Consulting Limited, Segun Oluwasanmi, has accused the revenue consulting firm of systematic tax evasion through the under-declaration of staff salaries and under-remittance of statutory taxes.

The allegations have now been escalated to the Nigeria Police, the Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Economic and Financial Crimes Commission (EFCC).

Copies were also sent to the Federal Ministry of Finance and the Lagos State Ministry of Finance.

Alpha-Beta Consulting, a private firm that assists the Lagos State Government in tax and revenue collection, is widely reported to be owned by President Bola Tinubu.

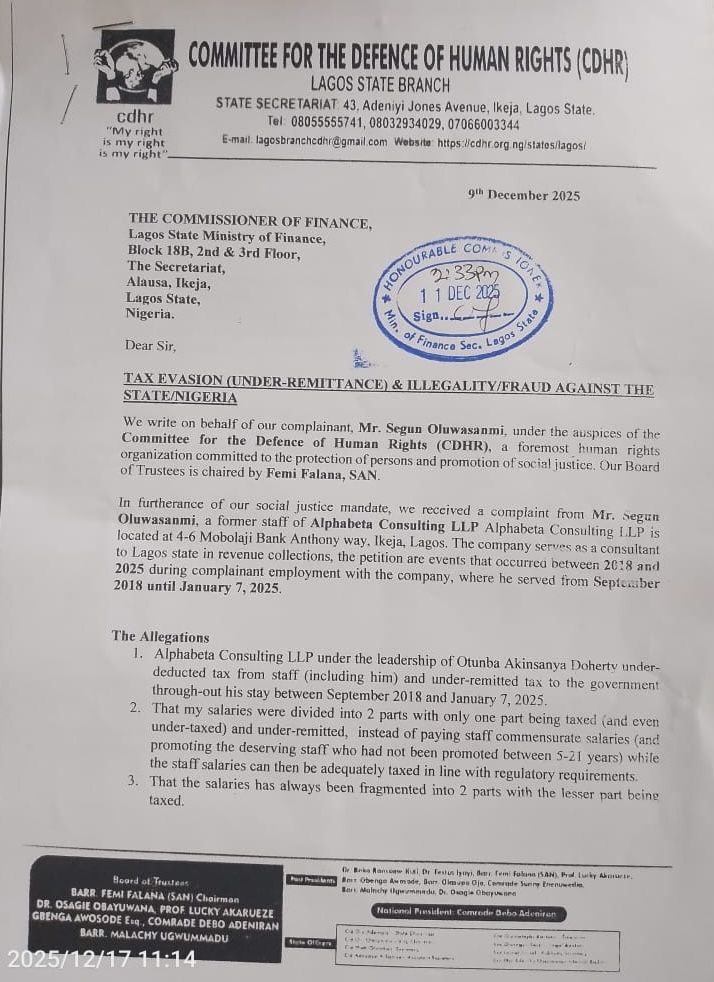

The allegations were submitted through the Lagos State chapter of the Committee for the Defence of Human Rights (CDHR), a civil rights organisation whose Board of Trustees is chaired by human rights lawyer Femi Falana, SAN.

In a detailed account of what he described as deliberate and long-running tax evasion practices, Oluwasanmi alleged that Alpha-Beta routinely split employees’ salaries into two parts, declaring and taxing only a fraction of the actual earnings while concealing the remainder from tax authorities.

“What Alpha-Beta has been doing is this: they divided our salary into two, so that they will not pay tax on everything,” Oluwasanmi said.

“What you will see in the payroll, especially up to 2022, is half of my salary. They were paying tax only on part of our salaries, and even on that part, they were underpaying.”

According to the whistleblower, the portion of salary that appeared on payroll records was the smaller component, meaning taxes were not only calculated on a reduced base but were also allegedly under-remitted.

“You are paying tax on the salary you divided into two. You are paying tax on one part. The part you are paying tax on, you are also still underpaying,” he added.

Internal correspondence from the company, which was attached to the petition, corroborates the whistleblower’s allegations.

A memo dated April 30, 2024 from Anjolaoluwa Grace Ige, Head of the company’s Human Capital Management Department, disclosed that a Lagos State Internal Revenue Service (LIRS) audit had uncovered under-remittance of tax.

The memo reads, “We are reaching out to inform you about an adjustment made to our pay in the current month, April 2024. During a thorough review of our payroll records conducted by External Auditors from LIRS, it has been brought to our attention that there has been an under-deduction in the PAYE deductions of all employees within the organization.

“In order to ensure compliance with tax regulations and to avoid potential penalties or sanctions, it has become necessary for us to rectify this variance. Consequently, a minor correction has been applied to ensure accurate and proper deductions moving forward.

“Please note that this correction has resulted in an increase in our PAYE deduction for this month, which encompasses under-deductions from January to April 2024. We understand that any adjustment to your expected earnings may raise concerns.

“Effective May 2024, there will be a slight increase in our monthly PAYE deductions compared to previous deductions. We take full responsibility for this oversight and sincerely apologize for any inconvenience it may cause. Our Finance team is readily available to address any inquiries you may have regarding this matter and to provide you with detailed information about the adjustment to your pay.”

“Anjola Ige, the head of HR, sent an email to us that an audit had exposed that we were underpaying or that Alpha-Beta was under-remitting. They said they were now ready to do the right thing, which was a lie,” the whistleblower said.

According to Oluwasanmi, rather than fully correcting the anomaly, the company merely adjusted tax deductions on the already-declared portion of salaries while continuing to conceal the other half.

He said the undeclared component was later rebranded as “reimbursable” to mask its true nature.

“Around 2023, they implemented partially what I suggested in 2019,” he explained. “The parts they were not paying tax on, to beat government, they now call it reimbursable. In my employment letter, there is nothing like reimbursable.”

He stated that pay slips from 2019 to 2022 clearly showed only half of his salary being declared, while documents from 2023 onward introduced a new payroll format featuring the “reimbursable” category.

“You will see two sets of pay slips. Before 2023, the payroll is different. From 2023 upward, you will see reimbursable,” he said.

Oluwasanmi further alleged that this practice negatively affected his professional standing, particularly when seeking new employment.

“When you go for interviews, they want to pay you based on your pay slip. If you are dividing my salary into two, you are doing injustice to me. I will be struggling to defend my salary,” he said, adding that the practice amounted to “stealing from the government.”

He said he first raised concerns internally as far back as 2019 during a meeting at Alpha-Beta’s Ijora office. “I said what we are doing is tax evasion and is criminal,” he recalled. “They said I talk too much. That was one of the areas where I ran into problems with them.”

In addition to tax-related allegations, Oluwasanmi alleged the company mishandled pension contributions in violation of the Pension Reform Act. According to him, Alpha-Beta allegedly deducted both the employee’s and employer’s pension contributions from staff salaries until 2022.

“They were deducting both from us due to inexperience and gross inefficiency,” he said. “When they regularised it in 2022, the part they deducted from me as their own contribution was never returned or remitted.”

In a formal petition dated December 9, 2025, and addressed to the Acting Zonal Director of the EFCC, Lagos Directorate 1, CDHR outlined the allegations in detail, accusing Alpha-Beta Consulting LLP of “tax evasion (under-remittance) and illegality/fraud against the state and Nigeria.”

The petition stated that Alpha-Beta, “under the leadership of Otunba Akinsanya Doherty, under-deducted tax from staff and under-remitted tax to the government throughout the complainant’s employment between September 2018 and January 7, 2025.”

It further alleged that salaries were “always fragmented into two parts with the lesser part being taxed, and even that part under-taxed,” while the larger portion remained undeclared.

The petition cited the internal HR email dated April 30, 2024, which allegedly confirmed that a LIRS audit had uncovered under-remittance, but noted that the company failed to fully regularise the issue.

According to CDHR, Alpha-Beta’s actions violate several Nigerian laws, including the Companies Income Tax Act, the Personal Income Tax Act, the Money Laundering (Prohibition) Act, and the Nigeria Tax Administration Act 2025.

The petition listed documentary evidence to support the allegations, including employment and increment letters, payroll records, tax remittance documents downloaded from the LIRS platform, bank statements showing fragmented salary payments, and internal emails acknowledging under-remittance.

“In view of the foregoing, we respectfully urge your office to investigate the tax evasion (under-remittance of tax) by Alphabeta Consulting and prosecute the management of Alphabeta Consulting in line with the laws of the land,” the petition, signed by CDHR Lagos State Chairman, Comrade Wale Ojo, stated.

.png)

.png) 1 month ago

276

1 month ago

276

English (US) ·

English (US) ·